Offshore Company Formation: Expert Tips and Insights

Offshore Company Formation: Expert Tips and Insights

Blog Article

Expert Insights on Navigating Offshore Firm Formation Effectively

The details involved in navigating the intricacies of overseas company development can be daunting for even experienced entrepreneurs. As we dive right into the subtleties of selecting the best jurisdiction, comprehending legal needs, managing tax obligation ramifications, developing banking connections, and ensuring conformity, a wide range of expertise waits for those looking for to grasp the art of offshore firm formation.

Picking the Right Territory

When taking into consideration overseas company formation, picking the ideal jurisdiction is an essential choice that can substantially affect the success and procedures of business. Each jurisdiction offers its very own set of lawful frameworks, tax obligation laws, privacy regulations, and financial rewards that can either hinder a company or benefit's objectives. It is vital to conduct thorough research study and look for specialist support to guarantee the selected jurisdiction straightens with the business's demands and goals.

Variables to take into consideration when picking a territory consist of the political and financial security of the region, the convenience of doing service, the degree of economic personal privacy and confidentiality used, the tax obligation implications, and the governing atmosphere. Some territories are recognized for their favorable tax structures, while others focus on privacy and asset security. Recognizing the one-of-a-kind characteristics of each jurisdiction is crucial in making a notified choice that will sustain the long-lasting success of the overseas business.

Inevitably, selecting the appropriate territory is a strategic step that can offer possibilities for development, property protection, and functional effectiveness for the overseas firm.

Understanding Lawful Demands

To guarantee compliance and legitimacy in offshore company formation, a thorough understanding of the legal requirements is necessary. Various jurisdictions have varying legal frameworks regulating the facility and procedure of offshore companies. Staying educated and up to day with the legal landscape is vital for successfully browsing offshore company development and guaranteeing the lasting sustainability of the company entity.

Browsing Tax Effects

Recognizing the elaborate tax obligation ramifications linked with overseas company formation is crucial for making certain conformity and maximizing monetary techniques. Offshore companies commonly provide tax obligation benefits, however browsing the tax landscape requires detailed understanding and correct preparation.

In addition, transfer prices regulations must be very carefully examined to guarantee purchases in between the overseas entity and related events are conducted at arm's size to avoid tax evasion allegations. Some territories offer tax incentives for certain industries or tasks, so comprehending these rewards can assist maximize tax financial savings.

Additionally, Click This Link remaining up here to day with evolving global tax obligation policies and conformity requirements is vital to prevent penalties and keep the business's reputation. Seeking professional advice from tax obligation specialists or consultants with experience in overseas tax matters can give useful understandings and make certain a smooth tax planning process for the overseas company.

Establishing Banking Relationships

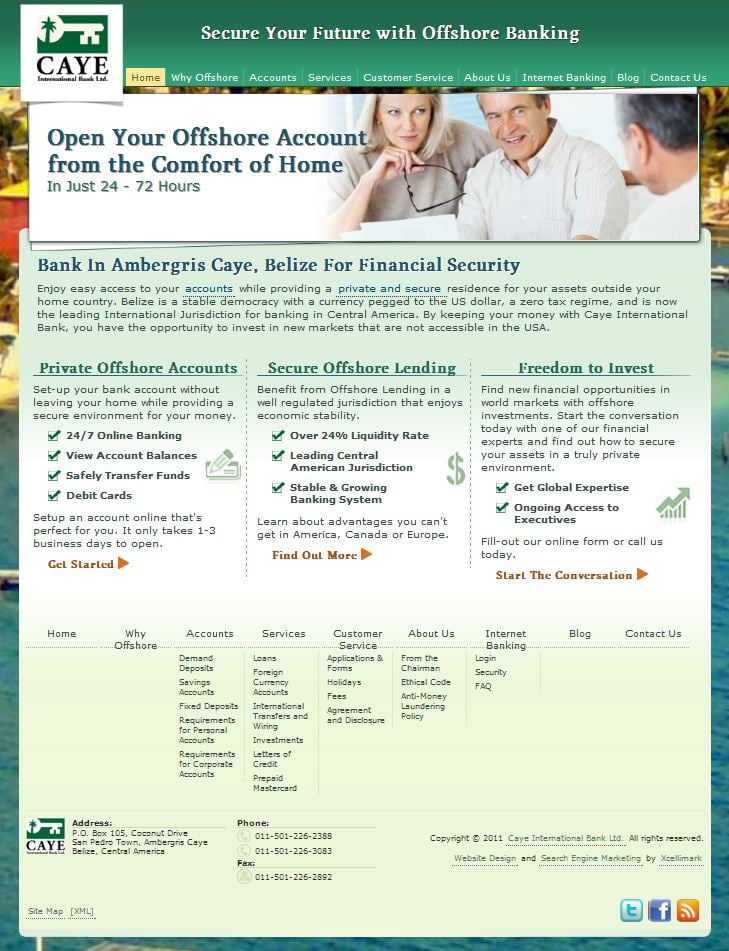

Developing secure and trustworthy banking connections is a crucial action in the procedure of overseas firm formation. offshore company formation. When setting up financial connections for an overseas firm, it is vital to select respectable banks that supply services customized to the particular requirements of international organizations. Offshore firms usually need multi-currency accounts, on the internet banking centers, and smooth global purchases. Selecting a bank with a global presence and expertise in managing overseas accounts can simplify monetary procedures and make sure compliance with international guidelines.

Additionally, prior to opening a financial institution account for an overseas business, thorough due diligence procedures are usually required to confirm the legitimacy of business and its stakeholders. This might involve giving in-depth documents concerning the business's tasks, source of funds, and valuable owners. Building a cooperative and clear connection with the chosen financial institution is crucial to navigating the complexities of overseas financial effectively.

Making Certain Compliance and Reporting

After establishing secure banking connections for an offshore firm, the next vital action is ensuring conformity and reporting measures are meticulously adhered to. Engaging lawful and monetary specialists with knowledge in overseas territories can aid navigate the intricacies of conformity and coverage.

Failing to abide by guidelines can result in serious charges, penalties, or also the cancellation of the overseas business's certificate. Therefore, remaining positive and alert in making certain conformity and coverage needs is crucial for the long-lasting success of an offshore entity.

Conclusion

To conclude, successfully navigating offshore firm development calls for cautious factor to consider of the jurisdiction, legal demands, tax effects, financial partnerships, compliance, and reporting. By comprehending these crucial aspects and guaranteeing adherence to laws, services can develop a strong foundation for their offshore procedures. It is critical to seek professional guidance and proficiency to navigate the complexities of overseas firm formation effectively.

As we dig right into the subtleties of selecting the ideal jurisdiction, recognizing legal needs, taking care of tax effects, developing banking relationships, and ensuring compliance, a wide range of knowledge awaits those seeking to grasp the art of offshore company development.

When considering overseas firm development, selecting the ideal jurisdiction is a critical choice that can significantly impact the success and procedures of the service.Understanding the elaborate tax implications connected with overseas business formation is vital for making certain conformity and maximizing financial approaches. Offshore business frequently give tax benefits, but browsing the tax obligation landscape calls for thorough expertise and appropriate planning.In final thought, successfully navigating offshore company formation needs careful factor to consider of the territory, legal needs, tax obligation ramifications, banking partnerships, conformity, and coverage.

Report this page